By Qingcheng Li, Yutong Liu, and Bing Chen

“The current impact investing is washing along the shores of a bifurcated world still organized to separate profit-making from social and environmental problem-solving.” Antony Bugg-Levine, CEO of the Nonprofit Finance Fund, said. In 2007, the term “impact investing” was coined by the Rockefeller Foundation, which is new to both the investing and the sustainability world. It is investments that generate social and environmental impact with a financial return. This is a very useful investing tactic when used to help pursue the Sustainable Development Goals (SDGs), global goals for the peace and prosperity of all nations, set by the United Nations in 2015.

However, there is still a funding gap to achieve the SDGs in the following 8 years as current levels of investment by governments and development agencies are insufficient. The United Nations Conference on Trade and Development (UNCTAD) raised that the cost gap needed to achieve the SDGs by 2030 in developing countries is estimated to be US$ 2.5 – 3 trillion per year.

Furthermore, with the influence of the COVID pandemic in recent years, the SDGs’ progress is stagnated. According to The Sustainable Development Goals Report 2022, the COVID crisis is putting the 2030 Agenda for Sustainable Development in grave danger and reversing the positive progress in health, education, nutrition, peace, security, and much more.

Impact investing raising and directing capital to address the social and environmental challenges is suitable to help achieve the SDGs. Now, there is already some successful impact investing that contributes to education, financial inclusion, and housing.

SDG 4 : Quality Education

Although fundamental skills such as reading and writing are addressed at schools, other vital societal challenges, such as binge drinking, sexual assault, and financial literacy, are under-addressed in academic education. A lack of relevant knowledge can result in life-changing problems. For example, according to the 2019 National Survey on Drug Use and Health, 14.5 million people ages 12 and over have suffered from alcohol use disorders in the United States. Moreover, only 7.2 percent of this population received any treatment in the past year before this study.

Also, there was statistical evidence from the U.S. Department of Justice (2019) that there are over 400,000 victims ages 12 and older of rape and sexual assault in the U.S. annually. Actions of sexual violence can be experienced in the workplace or school, affecting the victim’s relationship with the ones around them. These incidents often were not reported to the police, and victims often experienced symptoms of post-traumatic stress disorder after. Financial literacy is also crucial for all students to learn. After stepping into the society, one must know how to save and invest their money properly.

For the above problems, some companies have started working to increase awareness of these issues to the public through classes.

EverFi is the leading Software as a service provider of subscription-based educational and compliance content. The company educates students from kindergarten through grade 12, company employees, and communities on financial literacy, digital literacy, and health and well-being. Ever since its launch, EverFi has reached over 45 million learners globally.

Ever-Fi website homepage Photo credit: Everfi.com

Three programs of EverFi that were focused on included online courses ElcoholEdu, Haven, and financial literacy programs. AlcoholEdu, a course designed to prevent unhealthy dependency on alcohol among college students, was given at over 400 universities. Haven, another course that educates college students on harassment prevention, was used at 650 universities. And a program on financial literacy that was provided at over 6,100 high schools to inform students about credit cards, interest rates, taxes, and insurance.

In 2017, The Rise Fund invested 120 million in EverFi and took a 32% stake. The Rise Funds launched in 2016 under the management of TPG Rise —— the world’s largest private markets impact investing platform with more than $15 billion in assets.

When Rise Fund decided to fund this company, they used the Impact Multiple of Money (IMM) methodology to assess the potential impact. IMM estimates the financial value of the social and environmental good that will likely result from each dollar invested bore any money committed. In the process of evaluating IMM, Rise Fund estimated that an investment in EverFi could affect approximately 6.1 million students over five years, beginning in 2017.

Students taking Ever-Fi courses Photo credit: EverFi.com

The overall impact delivered is more significant than the IMM assessment. In 4 years, starting in 2017, Ever-Fi has reached 13 million students through its technology and learning platform. On top of a positive social outcome, the company’s continued investment and brand awareness have driven consistent double-digit growth.

Rise Fund had an estimated impact of USD 641 million during the hold and an impact stake of 8.2x, meaning that the company would make 8.2 dollars worth of social impact for every dollar invested.

Rise Fund has also yielded considerable financial returns on this investment. EverFi was purchased for approximately 750 million by Blackbaud in 2022, which the company’s shareholders will receive in a cash and stock transaction.

SDG 8: Decent Work and Economic Growth

In pursuit of SDG 8’s specific target of strengthening the capacity of domestic financial institutions to encourage and expand access to banking, insurance, and financial services for all, Chongho Bridge, a comprehensive rural service institution focused on serving rural micro and small businesses in rural areas is moving forward to achieve its goal. Chongho Bridge provides services including microcredit, microinsurance, e-commerce of agricultural inputs, direct procurement of agricultural products and technology training.

As the largest micro-finance institution in China, Chongho Bridge covers more than 100,000 villages in 20 provinces across China, with a maximum lending distance of 900 kilometers. 77.56% of the clients are farmers, 72.25% are women, and 79.80% have a junior high school education or less.

In terms of financial inclusion, Chongho Bridge offers two basic services to its clients: microcredit and microinsurance. Microcredit is granted following the principle of “small and dispersed” to support clients’ revenue-generating activities, and the credit provides an interest-free period of up to six months. The microinsurance service of Chongho Bridge is characterized by small insurance amounts, low premiums, and a short period. It can actively play a preventive role in serving rural production and living areas.

No matter where customers are, Chongho Bridge, which is committed to “serving the last 100 meters in rural areas”, has enabled many customers in remote areas to enjoy timely financial services.

In the town of Alongshan, at the foot of the Great Khingan Mountains in Inner Mongolia, the snow season lasts for eight months. Mrs. Sun Guolian, who is in her fifties, raises reindeer and sells the by-products of reindeer. Although reindeer farming can bring good revenue, she often encounters the problem of poor cash flow. Because of the remoteness and the lack of internet and cell phone signals, many traditional financial institutions are reluctant to come and provide services.

By chance, Mrs. Sun met the staff of Chongho Bridge in the town, who promised to call them and visit her.

“I told them that I was raising deer in the mountains and it was quite far away, so I was ready to be rejected at that time, but I didn’t expect that they would agree to come directly,” said Mrs. Sun, who had been rejected many times.

Chongho Bridge account manager and supervisor visited Mrs. Sun

Photo Credit: Chongho Bridge

After the Chongho Bridge manager drove to her home to do the household survey, Mrs. Sun quickly got the 30,000 Yuan she applied for and used the money to buy concentrated feed for reindeer. Since then, she has become a loyal customer of Chongho Bridge.

At the same time, Chongho Bridge also actively contributes to the modernization development of agriculture and rural areas, using technological and data tools in the production of agriculture.

Chongho Bridge has started the service mode of Contract Farming and has cooperated with many cooperatives to create a sound industrial chain for sales. Chongho Bridge also uses modern technology to spread medicine and fertilizer by drones. One drone operation can reach up to 200 acres per hour, and the medicine box can spray 20 acres once it is filled. This was the workload of ten workers for several days in the past. Now an aircraft can be done in a few hours, showing the significant contribution and value of technology to agriculture.

Chongho Bridge employees use Drones to Help Farmers Spray Pesticides

Photo Credit:Chongho Bridge

In addition, Chongho Bridge uses technology to empower rural areas and help improve digital services in rural areas. “Xiangzhu” is a rural digital service platform where farmers can take advantage of a wide range of services, including information, e-commerce, finance, technical training, entrepreneurial counseling, and much more.

In terms of financing, Chongho Bridge has also received support from many influential investment companies, such as Sequoia Capital, Ant Financial Services, and Renda Prudential. In 2018, Chongho Bridge completed a Series C funding round of RMB 600 million, led by The Rise Fund. Sun Qiang, the Managing Partner of TPG China, said, “As the largest rural microfinance platform with the widest coverage in China, Chongho Bridge generates both great social benefits and commercial success, which fits perfectly with The Rise Fund’s investment strategy.”

In 2021, Chongho Bridge completed a new round of 1 billion RMB financing led by OTPP and followed by ABC World Asia. In terms of the new round of investment, Chongho Bridge is very popular with capital and has very good prospects.

SDG 11: Sustainable cities and communities

One of the SDG 11 targets claimed to make cities and human settlements inclusive, safe, resilient, and sustainable and aimed to update slums by 2030. Although there has been some progress in these years worldwide, Africa is still facing a severe housing crisis.

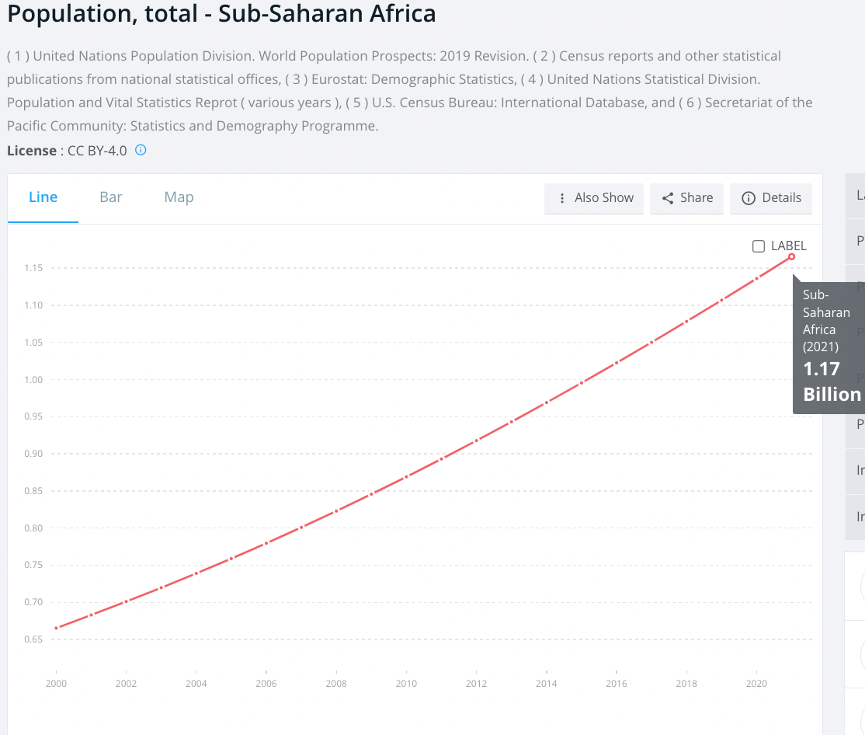

The demand for housing in sub-Saharan Africa is increasing because of the increasing population of Africa these two decades, from 665 million to 1.17 billion. According to a statistical report by the United Nations Department of Economic and Social Affairs, 230 million people are living in slums in sub-Saharan Africa causing rapid urbanization, ineffective planning, and a lack of affordable housing. The population increase in slums in Africa puts them at greater risk of mental health problems, respiratory and diarrhoeal disease, and vector-borne diseases such as malaria.

Increasing population in Sub-saharan Africa Graph

Credit: World Bank

However, the slum problem cannot easily be solved by the government. Although many governments in Africa tried to directly provide housing for this growing population, their financial situation cannot meet the costly program. Meanwhile, private companies can gain financial returns while they design more strategic approaches to the housing problem with a positive impact on society and the reputation received by the company.

Based on the need for low-cost and high-quality housing in sub-Saharan Africa, Kora – a developer of residential projects in Angola launched an urban community platform called Kora Housing. The goal of the project is to construct affordable, high-quality housing units on various sites around Angola that can accommodate 240,000 residents. Moreover, Kora provides an urban community with quality urban infrastructure, educational facilities, health facilities, commercial and service areas, and leisure areas.

Kora used its distinctive construction technique, which was autoclaved aerated concrete, allowing construction to be developed faster and cost-effectively in Angola. The entire project process including engineering, logistics, project management, IT, marketing, and sales has been done locally allowing further cost reduction.

Besides providing a home to live in, the Kora housing project established a new concept called Cidades Horizonte (Horizon Cities). The urban project was planned to use a logic of blocks that were incorporated into economic, cultural, and educational hubs. This project encourages contact and interaction between people. The street in Kora communities does not only mean a public road but a “meeting point” for every family in the community. In each area of Kora Housing, there are public spaces without barriers so that all the residents receive an extension of their house to connect with others in the community.

New Centralities projects represent the most significant part of Kora’s activities, which include the construction of dwelling units, social facilities, commercial areas, health, and education support centers spread across 14 New Centralities in 6 provinces of Angola. In each centrality, Kora’s residents enjoy many developed city traits, such as quality education facilities, healthcare services, and modern sanitation and transportation. In 2016, 1200 families moved into their new homes in Lossambo, a fully equipped community established by Kora Housing mentioned above. To improve learning opportunities, Lossambo’s first school was built in January 2017, where children could enjoy a more equal education.

The bird’s eye view of Lossambo centrality

Photo credit: Kora.cn

Vital Capital, which invested 92 million dollars, is the leading investor in Kora housing. Funded in 2011, this investment company is one of the early impact investing funds focused on sub-Saharan Africa. By the time Vital Capital exited the Kora program in 2017, there were 20,000 affordable houses for 100,000 individuals across 6 cities in Angola with 6 healthcare centers and 51 education facilities.

Besides housing, education, and financial services, impact investing is constantly building social impact on sustainable agriculture, healthcare, resource conservation, and more. The demand for sustainable, impactful investments is growing, and investors are increasingly interested in putting money into projects that have a positive social and environmental impact, helping to achieve the United Nations’ 17 Sustainable Development Goals more quickly.

“This type of investing is becoming more popular as people realize that profits and purpose can go hand-in-hand,” observed Tatiana Mitrova, a research fellow at Columbia University.

References

https://thegiin.org/impact-investing/need-to-know/

https://unstats.un.org/sdgs/report/2022/

https://data.worldbank.org/indicator/SP.POP.TOTL?end=2021&locations=ZG&start=2000&view=chart

https://kora.co.ao/en/planeamento-e-desenvolvimento-urbano/

https://vital-capital.com/wp-content/uploads/2021/12/Vital-Capital_Evolving-Impact.pdf

https://www.niaaa.nih.gov/publications/brochures-and-fact-sheets/alcohol-facts-and-statistics

https://bjs.ojp.gov/content/pub/pdf/cv19.pdf

https://www.rainn.org/statistics/victims-sexual-violence

https://therisefund.com/news/tpg-rise-named-fortunes-change-world-list

https://hbr.org/2019/01/calculating-the-value-of-impact-investing

https://therisefund.com/impact-report-highlights

https://guancha.gmw.cn/2020-03/28/content_33693663.htm#:~:text

https://tech.chinadaily.com.cn/a/202105/21/WS60a760a6a3101e7ce9750e5f.html

https://baijiahao.baidu.com/s?id=1747903621790959236&wfr=spider&for=pc

https://www.csai.cn/v/198.html

https://www.adb.org/zh/news/adb-cd-finance-sign-loan-support-rural-microcredit-farmers-entrepreneurs-and-women-borrowers