Impact investments are investments aimed to generate positive, measurable environmental and social impact with a financial return. The growth of the impact investment market provides capital to solve the world’s most challenging sectors such as renewable energy, agriculture, conservation, education and healthcare. Impact investing challenges the long-held views that environmental and social issues should be handled by philanthropic donations and market investments should rely mainly on achieving financial returns. When investing for sustainability impact, investors intend to use the money to support or influence the nature of company management to promote positive changes in the economy for the benefit of the society and environment. The main goal of impact investing is to form both tangible financial return while benefiting environmental and social factors.

Why Impact Investing?

Several studies have proved that an investment portfolio of sustainable investments can be built without harming the financial returns. This news is the green light to fund the financial goals while supporting companies with sustainable impacts. Impact investments can be found in both established and developing markets. As this grows in popularity across the market, a new sense of capital is expended to face global predicaments across different sectors such as sourcing renewable energy, sustainability in agriculture, overall conservation of value resources, education, healthcare and providing basic needs and housing for developing countries and communities.

Does impact investing help the environment?

Impact investing does not just provide financial return to the company’s economic sector, it also supports an easy and convenient ways to solve the environmental issues. Since impact investments intends to improve a company’s contribution to environmental, social and corporate governance (ESG) factors, they give a way to handle social issues created by climate change within doing any additional work. They help to promote more sustainable business habits and it is like killing two birds with one stone.

Benefits of Investing in Renewable Energy

Among environmental projects, financing in renewable energy is one of the ways for impact investing. In a developing country, financing renewable energy is totally different, especially off-grid energy since it improves the lives of the local communities. By providing lighting, telecommunications and refrigeration to off-grid communities ensure better education, health care and economic opportunities. It is also a way to replace kerosene lamps for lighting and diesel generators for power which can harm the environment badly.

Off Grid Solar Energy

The blind-spot of huge investments in renewable energy and the projects of decarbonized transport struggle will have only a medium-term result for climate change impact on vulnerable communities. They do not actually tackle the immediate needs of the bottom of the pyramid. The stakeholders are required to relate the most pressing issues such as education, sanitation, gender equality, commoditized agriculture, eroded soils and coastlines, raw material extraction and access to clean energy.

Future outlook and benefits of renewable energy

Impact investments in renewable energy are still a top choice for the investors. Even with the global pandemic impact, the renewable sector is full of potential in the long-term outlook. The future of renewable energy is becoming more important day by day. With the growing global population, over production and over consumption lead to inefficient systems for distribution of energy, food and water. Investing in renewable energy is no longer an option or win-lose situation. With the advancement of technology advancement and increasing demand for companies to provide a positive impact on the world, creating a real profit by leveraging sustainable impact becomes a crucial method.

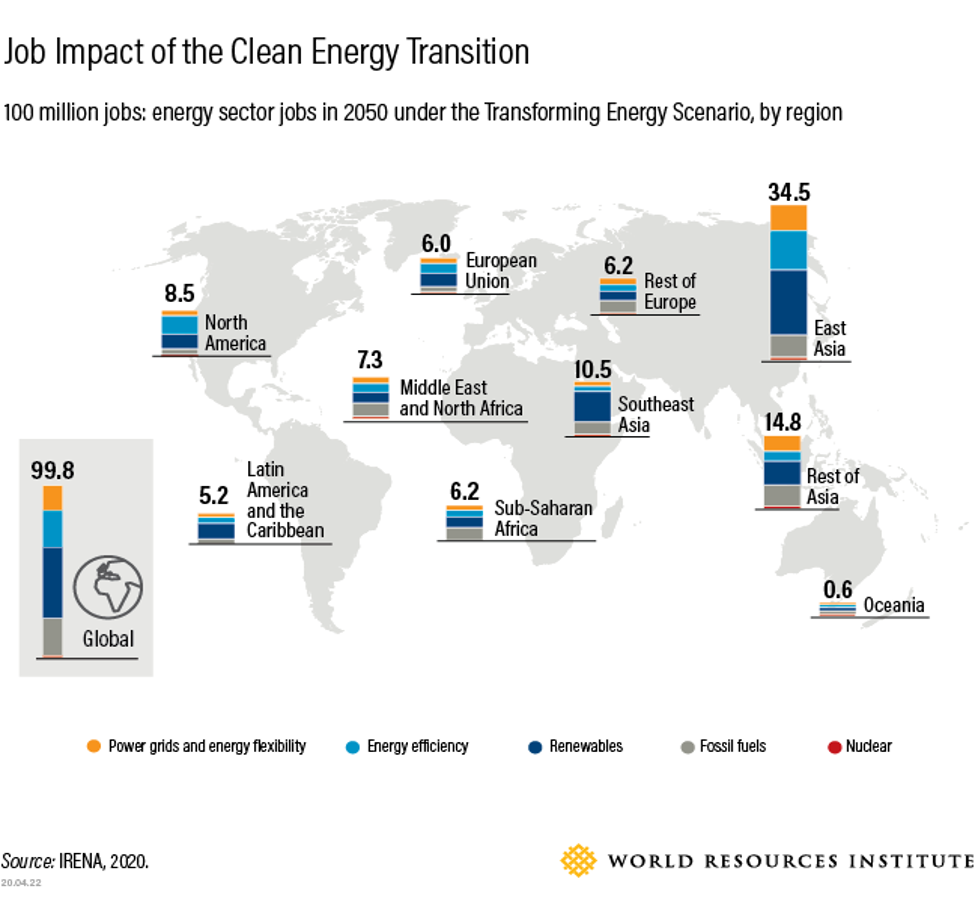

According to the International Energy Agency, the most energy-efficient jobs create local employment opportunities with small and medium enterprises. Renewable Energy World states that the number of renewable energy jobs globally could be more than triple, with 42 million jobs by 2050, while energy-efficiency jobs would grow six-fold, creating jobs for more than 21 million people over the next 30 years.

Since the renewable energy sector provides both financial return to the investors and environmental and social contribution to the community, that can be a good potential to generate more capital for environmental investments in the future. It is always essential to look for new technology and methods to ensure that the investments can generate a positive impact with a sustainable future. Although there are many challenges and new things to learn, investors can look for a better outlook by increasingly supporting renewable energy.

References

https://thegiin.org/impact-investing/need-to-know/#what-is-impact-investing

https://www.thebalancemoney.com/what-is-investing-for-sustainability-impact-5213377

https://greenly.earth/en-us/blog/ecology-news/impact-investing-all-you-need-to-know-in-2022

https://walterschindler.com/sustainable-investments/renewable-energy-investments/