The green financing sector is expanding quickly and provides consumers and businesses with an affordable alternative to lower their carbon footprint. This industry covers a variety of environmentally friendly sources, such as recycling programs and solar energy development. In order to develop and implement ecologically friendly corporate processes, products, and services, green finance relies on a variety of financial sources.

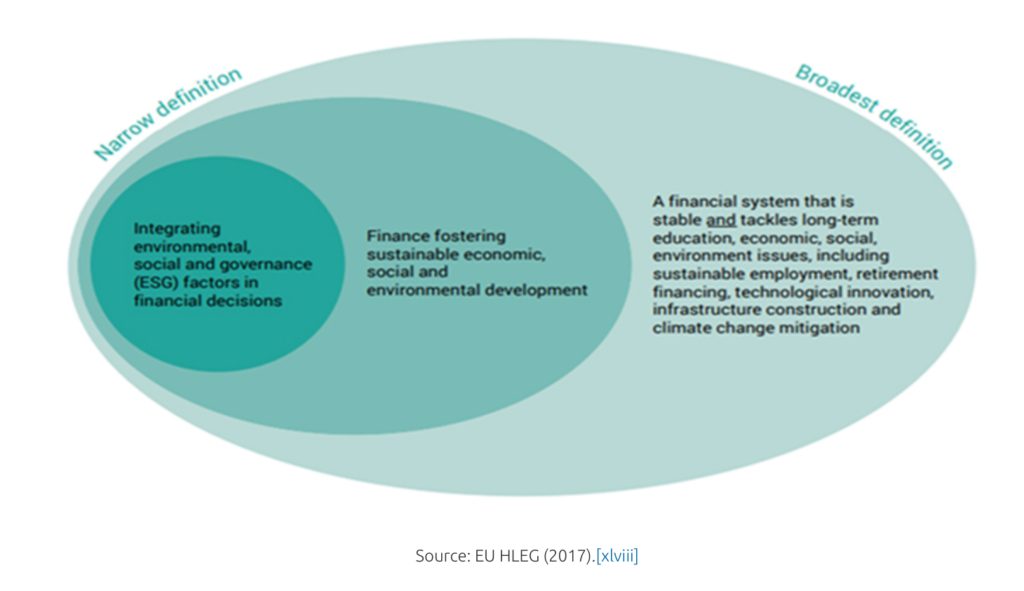

What is sustainable finance?

The term “sustainable finance” refers to a variety of green financing strategies targeted at funding enterprises, initiatives, and ideas that have a good social and environmental impact. It is a form of financing and investing that focuses on promoting sustainable development by investing capital in projects that support it. The main objective is to allocate financial resources to opportunities across various asset classes that strengthen mitigation and adaptation efforts to address climate change. It also includes the steps taken by people and organizations to reduce their environmental impact. This can involve everything from choosing energy-efficient products to using sustainable manufacturing techniques. The business sector, pension funds, central banks, and non-profit organizations from all over the world are just a few of the groups involved in sustainable finance. Green loans or bonds, renewable energy equity financing, carbon credits, public institutional equity investing, and other similar projects are a few examples of sustainable finance.

How does this work?

Alternatives to traditional financial systems include green financing and green finance. In order to earn returns without investing in the stock market or environmentally detrimental businesses like the fossil fuel industry, sustainable finance involves using life insurance policies, annuities, and even mutual funds. Social trade, in which people offer goods or services online to help one another, often without monetary exchanges, is another fact of green finance that is worthwhile researching. While this arrangement might be advantageous for both parties, caution should be used and the appropriate safety measures should be taken.

Who are key providers of sustainable finance?

When it comes to attracting capital for the green business, banks are key players. By utilizing cutting-edge financing techniques like carbon trading and green bonds, international financial institutions may promote the efficient expansion of green technology initiatives. Governments, financial supervisors, and central banks make decisions about how public funds are distributed for green projects and give institutional backing on a national scale. In order to facilitate green and sustainable investments, stock exchanges usually specialize in this area. Moreover, corporations have a critical role as the main conduit for climate funds through their CSR initiatives and investments across various sectors such as renewable energy and transportation.

Why it is important?

Forests and agriculture account for almost 30% of market value, yet they only receive a little amount of climate finance support. To combat this, the Bonn Challenge established challenging restoration goals, hoping to recover 350 million hectares of land globally by 2030. The UN Decade for Ecosystem Restoration started with the goal of increasing funding for restoration initiatives. The Nature Conservancy’s research emphasizes the need for at least $200 billion by 2030 to stop biodiversity loss and tackle climate change. The multiple sustainable development goals established by public and private companies, as well as the 2030 UN Sustainable Development Goals, must all be accomplished with great effort.

The establishment of industry standards and regulations, the monitoring of pollution levels at polluting entities to ensure compliance with legislation, and the delivery of training programs to encourage carbon footprint reduction are all important tasks performed by UN Environment. A concerted effort spanning local and global scales is required to close the substantial financing gap. This pressing global agenda emphasizes the requirement for a thorough transition toward sustainability. Investors had to make a decision between financial gain and environmental effects in the past. But the rise of sustainable finance has altered this choice-making procedure. In today’s market, more investors are actively looking for ways to invest in businesses that not only attempt to better the world but also provide appealing returns on their capital.

How does sustainable finance attract investors and catalyze private investment?

For sustainable businesses, debt and equity are the two main financial tools. Both loans and bonds can be used for debt financing. Leverage is used by businesses to reduce perceived investment risks when making green investments in order to attract private investors. Public banks frequently support investments by limiting risks through lending or credit guarantees, thus shifting the investment risk to the organization serving as a loan guarantor. Impact investors and climate funds have the option to choose a corporation’s most senior debt position (subordinated debt) and obtain advantageous dividends in the case of debt cancellation or insolvency.

What is the advantage of sustainable finance for investors?

When making investing decisions, investors are increasingly using a values-based framework. Whether their goal is to make the earth healthier for future generations or to actively contribute to immediate positive change, it is sensible to look into investments that will not only provide them with healthy returns but also support their underlying beliefs. Investors do, however, also understand the value of promoting sustainable company models and economic growth. In particular, ESG investments address intangible elements like brand value and consumer loyalty while also considering the possible effects of moral scandals and safety violations on their investment portfolios.

Why sustainable finance is important in deciding the investment?

Prioritizing green finance while making big investments is advised for two reasons in particular. Firstly, compared to many other assets in today’s economy, green resources offer more financial certainty. The environmental component comes in second and is of the utmost importance. Compared to other forms of funding or products, green innovations are less harmful to the environment. As different markets need various service levels, multiple financing options are available for sustainability projects. This includes programs aimed at environmental sustainability, corporate sustainability, or even divesting from fossil fuel firms.

Future outlook

Impact investments, such as green bonds, sustainability bonds, or energy efficiency programs, can generate large returns. It is essential to assess and address sustainable finance’s influence on the environment rather than only concentrating on the financial risks related to environmental variables in order for it to truly assist environmental sustainability. It is critical to hasten the transition to a financial system that considers the welfare of both people and the earth, taking into consideration its own effects on climate and biodiversity. In order to address these issues, it is necessary to adopt an environmental materiality viewpoint and improve the evaluation, management, and disclosure of the risks and negative impacts that businesses and financial actors pose to the environment, biodiversity, and society.

References

https://www.weforum.org/agenda/2022/01/what-is-sustainable-finance/

https://www.orfonline.org/expert-speak/how-finance-can-deliver-real-environmental-climate-impact/