Singapore, known as the ‘Garden City,’ is advancing towards the goal of becoming a ‘City in Nature’ through its evolving national strategy. In the context of high urbanization, how can the balance between urban development and biodiversity conservation be achieved? Singapore has provided its own answer.

From a ‘Garden City’ to a ‘City in a Garden’, and now a ‘City in Nature’, the Singapore government has gradually constructed a unique path towards nature-positive development. This strategy goes beyond traditional urban beautification, integrating ecological protection, natural resource management, and policy innovation, laying a comprehensive path towards biodiversity conservation and sustainable development.

To promote nature conservation, Singapore launched the ‘National Biodiversity Strategy and Action Plan’ (NBSAP), clearly establishing the maintenance of biodiversity as a core task of national sustainable development. At the same time, the Monetary Authority of Singapore (MAS) has also launched green bonds and sustainable loan programs to fund nature-positive projects. These initiatives not only accelerate the implementation of projects but also guide enterprises and financial institutions to incorporate natural assets into core decision-making, directing capital towards the field of ecological value.

With a strong financial infrastructure and continuously deepening policy support, Singapore has attracted the favor of capital. Its systematic nature-positive path not only meets the global market demand for biodiversity conservation and sustainable development but also provides a reliable natural financial system for enterprises and investors.

DBS Bank Leading Nature-Positive Investment

As a key driver of nature-positive investment, banks play a crucial role in ecological protection and sustainable development. As the largest commercial bank in Singapore, DBS injects new vitality into biodiversity conservation and ecological sustainable development through innovative financial tools and standardized management.

2.1 The Key Role of Banks in Nature-Positive Investment

According to the ‘State of Finance for Nature 2021’ report released by the United Nations Environment Programme (UNEP), Nature-Based Solutions (NbS) investment is defined as the flow of funds to nature-related activities or assets, aiming to provide positive financial support for nature conservation activities or the management of natural assets. This definition provides a reference direction for nature-positive investment and also reflects the significant potential of financial institutions in promoting natural resource conservation and sustainable development.

Banks become core drivers of nature-positive investment through capital guidance, risk management, and international cooperation. As an industry leader, DBS Bank incorporates natural asset risks into its decision-making process and considers sustainable development as one of its core strategies. DBS plans to achieve a sustainable financing target of 50 billion Singapore dollars by 2024, focusing on areas such as green buildings, renewable energy, and natural asset protection. This vision fully demonstrates its leadership and innovative practices in nature-positive investment.

2.2 Collaboration between DBS and CDL

DBS Bank (DBS) and City Developments Limited (CDL) have jointly launched Singapore’s first sustainability performance-linked loan aligned with the Taskforce on Nature-related Financial Disclosures (TNFD) targets, injecting new momentum into biodiversity conservation and sustainable development. This loan, amounting to up to 400 million Singapore dollars, is guided by TNFD recommendations and sets a series of challenging targets, becoming an innovative model among similar financial solutions. However, due to the limited details of the relevant cooperation, the existing information mainly comes from news reports by DBS and CDL, as well as the CDL 2024 Integrated Sustainability Report.

According to existing reports, CDL’s leadership role in this cooperation is particularly prominent. Ms. Yiong Yim Ming, Chief Financial Officer of CDL, stated that the company has secured over 8 billion Singapore dollars in sustainable financing since 2017 to develop smarter, greener, more nature- and climate-friendly infrastructure. This loan not only continues CDL’s philosophy of ‘Conserving as We Construct,’ but also further directs capital towards green buildings and climate action through robust sustainability reporting. As the first company in Singapore to voluntarily disclose according to TNFD recommendations, CDL also includes disclosures in its 2024 Integrated Sustainability Report that align with the goals of the Kunming-Montreal Global Biodiversity Framework.

From DBS’s perspective, this collaboration highlights the bank’s innovative capabilities and important role in supporting companies to achieve nature-related goals. Mr. Chew Chong Lim of DBS pointed out that as the importance of biodiversity and ecosystem protection becomes increasingly apparent, DBS hopes to drive economic growth and ecological management in tandem by incorporating these factors into financial solutions.

This collaboration builds on the long-term partnership between CDL and DBS. As early as 2017, DBS supported CDL in issuing Singapore’s first corporate green bond; in 2019, the two parties launched the first sustainability-linked loan. In 2023, DBS also supported CDL’s supply chain carbon management program. This series of collaborations not only reflects DBS’s continuous efforts in providing financial support but also demonstrates its key role in helping enterprises achieve nature-positive goals through financial instruments.

The TNFD Framework is the core guideline of this collaboration, focusing on systematically disclosing nature-related risks and opportunities, enhancing the transparency and accountability of nature-related financial information, and achieving more consistent measurement standards. The proceeds from this loan are widely applied in various fields such as biodiversity conservation, waste management, and water use efficiency, setting a benchmark for transparency in natural asset management. This not only aligns with the recommendations of the TNFD but also demonstrates how financial institutions can support companies in achieving key goals in the nature-positive domain through innovative practices.

Although it is currently unclear which party, DBS or CDL, played a leading role in the collaboration, this cooperative practice indicates that Singapore’s financial institutions are actively promoting transparency in biodiversity conservation and natural asset management by introducing the TNFD framework. In the future, this type of cooperative model is expected to become a paradigm for Singapore’s financial market in supporting global sustainable development.

2.3 Overview of the TNFD Framework

Established in 2021, the TNFD is a market-led, science-based, and government-supported global initiative aimed at providing organizations with a risk management and disclosure framework. It helps companies identify, assess, and report nature-related dependencies, impacts, risks, and opportunities, and take corresponding actions. Through a standardized disclosure system, the TNFD promotes transparency in natural asset management, provides a scientific basis for investment decisions, and assists companies in achieving long-term sustainable development.

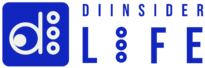

The TNFD framework revolves around four core elements: governance, strategy, risk and impact management, and metrics and targets (Figure 1), guiding companies to integrate natural factors into business decisions, thereby enhancing the potential for sustainable development. The governance aspect requires companies to disclose oversight and accountability mechanisms for nature-related issues to ensure effective management; The strategy aspect focuses on the impact of natural factors on business models and financial planning, encouraging companies to proactively adjust strategies to address risks; The risk and impact management aspect helps companies identify and prioritize nature-related risks and opportunities, optimizing management effectiveness; At the level of indicators and targets, companies are required to set quantitative performance goals and disclose natural asset management outcomes to enhance transparency and continuous improvement capabilities.

To implement the framework, TNFD has proposed the LEAP method to help companies systematically manage nature-related issues. This method includes four stages: the positioning stage identifies the connection points between a company’s business and natural assets, with a particular focus on dependencies and impacts on sensitive areas; The evaluation stage quantifies the degree of dependence on natural resources and ecological impacts, identifying key areas; The assessment stage further measures risks and opportunities, determines priorities, and proposes management solutions; In the preparation phase, incorporate natural risks into corporate strategy, set targets, and enhance transparency and accountability through regular disclosures.

The implementation of TNFD brings significant benefits to businesses and investors. From a corporate perspective, TNFD provides scientific support for natural asset management, helping companies enhance market recognition and long-term competitiveness through clear disclosures. For example, the sustainability-linked loan launched by DBS in collaboration with CDL ties corporate performance to biodiversity conservation, waste management, and water resource efficiency, setting clear sustainability goals to incentivize companies to achieve substantial results in natural resource management. CDL’s practices not only provide a model for other enterprises to emulate but also promote the global application of the TNFD framework. For investors, the TNFD framework enhances the transparency of nature-related information, helping them to more accurately identify and assess potential risks and opportunities of projects, optimize investment decisions, and ensure that capital flows to projects with long-term ecological and economic value. In addition, the standardized disclosure mechanism further enhances the credibility of financial products, boosting investor confidence in nature-positive investments.

2.4 CDL’s TNFD Report

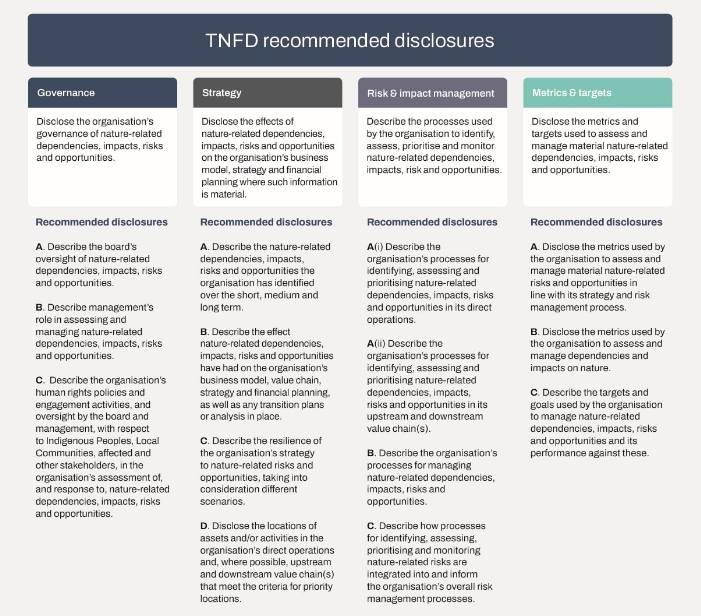

In the CDL 2024 Integrated Sustainability Report, CDL systematically showcases its natural asset management practices based on TNFD recommendations, focusing on four core elements: governance, strategy, risk management, and metrics and targets. This fully demonstrates the company’s foresight and leadership in nature-positive investment, providing a standard template for managing nature-related risks and transparent disclosure.

At the governance level, CDL oversees the implementation of nature-related matters through its Sustainability Committee (BSC) to ensure proper governance. The company tracks and discloses the implementation of the Future Value 2030 Sustainability Blueprint through quarterly sustainability reports and annual integrated reports. Since 2003, CDL has implemented an Environmental, Health, and Safety (EHS) policy covering key areas such as green procurement, climate change, and biodiversity, and has strengthened compliance management through a supplier code of conduct. In addition, CDL actively engages in employee participation activities and building management practices, such as EHS risk assessments at construction sites and triennial indoor air quality (IAQ) assessments, to continuously optimize environmental performance.

At the strategic level, CDL regards sustainable finance as an important means to drive nature-positive development and has actively adopted sustainable financial solutions since 2017. At the same time, the company extensively applies biophilic design and nature-based solutions (NbS) in project design and establishes cross-sector partnerships with various stakeholders. Through annual materiality analysis, CDL identifies key nature-related issues and continuously improves its biodiversity and climate policies. In addition, the company has clarified its long-term development goals and strengthened its commitment to sustainable procurement through the ‘Future Value 2030 Sustainability Blueprint’ and Sustainable Investment Principles (SIP).

In terms of risk and impact management, CDL has established a comprehensive nature-related risk management process, regularly communicates with internal and external stakeholders, and conducts annual materiality analysis through third-party consultants. Since 2010, the company has conducted Biodiversity Impact Assessments (BIA) before developing green buildings to reduce the risk of damaging natural habitats. In addition, since 2013, CDL has introduced an Enterprise Risk Management (ERM) framework and completed its third climate change scenario analysis in 2022 to deeply identify nature-related risks and opportunities. Notably, in 2023, the company took the lead in adopting the Xylo system to monitor its ecological footprint, further enhancing the scientific basis and transparency of natural asset management.

At the level of indicators and targets, CDL conducts information disclosure based on multiple international frameworks, including the Global Reporting Initiative (GRI), Carbon Disclosure Project (CDP), Sustainable Development Goals (SDGs), and the Task Force on Climate-related Financial Disclosures (TCFD) framework. In addition, the company has clarified key objectives, such as the ‘Future Value 2030 Sustainability Blueprint’ and the Kunming-Montreal Global Biodiversity Framework (Target 15), and has set specific monitoring indicators, including key areas like wastewater discharge, waste management, water resource use efficiency, spatial occupation, and natural state, to ensure that the performance of natural asset management is quantifiable and traceable.

Through the ‘2024 Integrated Sustainability Report,’ CDL successfully applied the TNFD Framework to corporate management, providing a scientific practice path for natural asset management. Its systematic governance, strategy, and risk management mechanisms, along with standardized information disclosure, not only achieved standardization and transparency in corporate natural asset management but also provided replicable practice cases for global nature-positive investment and biodiversity conservation.

Global Challenges and Opportunities in Biodiversity Conservation

The Global Risks Report 2024 released by the World Economic Forum indicates that biodiversity loss and ecosystem collapse have become one of the most severe global risks, profoundly affecting global economic and social development. As society’s production increasingly relies on healthy ecosystems, biodiversity conservation has become a key factor in promoting global economic sustainable development.

To address this challenge, financial institutions are guiding funds towards biodiversity conservation and ecological restoration projects through innovative financial instruments such as green bonds and sustainability-linked loans, aiding in ecosystem recovery and long-term sustainable development. However, in practice, nature finance still faces numerous challenges such as lack of data transparency, absence of standardization, and inadequate policy coordination. This not only tests the foresight and execution of national policies but also requires cross-sector collaboration and innovation.

Therefore, only through global collaboration and policy support, combined with the innovative practices of financial institutions, can the goals of biodiversity conservation be effectively promoted, injecting new vitality into global sustainable development.

Author: Guo Jing

Producer and editor: Li Bolun